You’ve gotta Roll with It – because Q3 has come and gone faster than a sold-out Oasis gig! From the Gallagher brothers wrapping up the UK leg of their long-awaited reunion tour to a host of shiny new cars making their Goodwood debuts and England’s Red Roses charging towards Rugby World Cup glory, it’s been a busy summer season.

But while the spotlight’s been on heatwaves, hill climbs and high hopes, here at Dealer Auction we’ve kept our eyes on the road – tracking every twist and turn in the trade. And Q3 brought its fair share of movement across stock, pricing and buyer behaviour.

In this edition, we’re digging into how Q3 2025 stacked up against Q2, and how it compares to the same period in 2024. With seasonality, sentiment and supply all playing their part, there’s plenty to unpack before we shift gears into the final stretch of the year.

So, What’s the Story? Fire up the kettle, crank up the volume and read all about it…

13 (million) – very lucky for some!

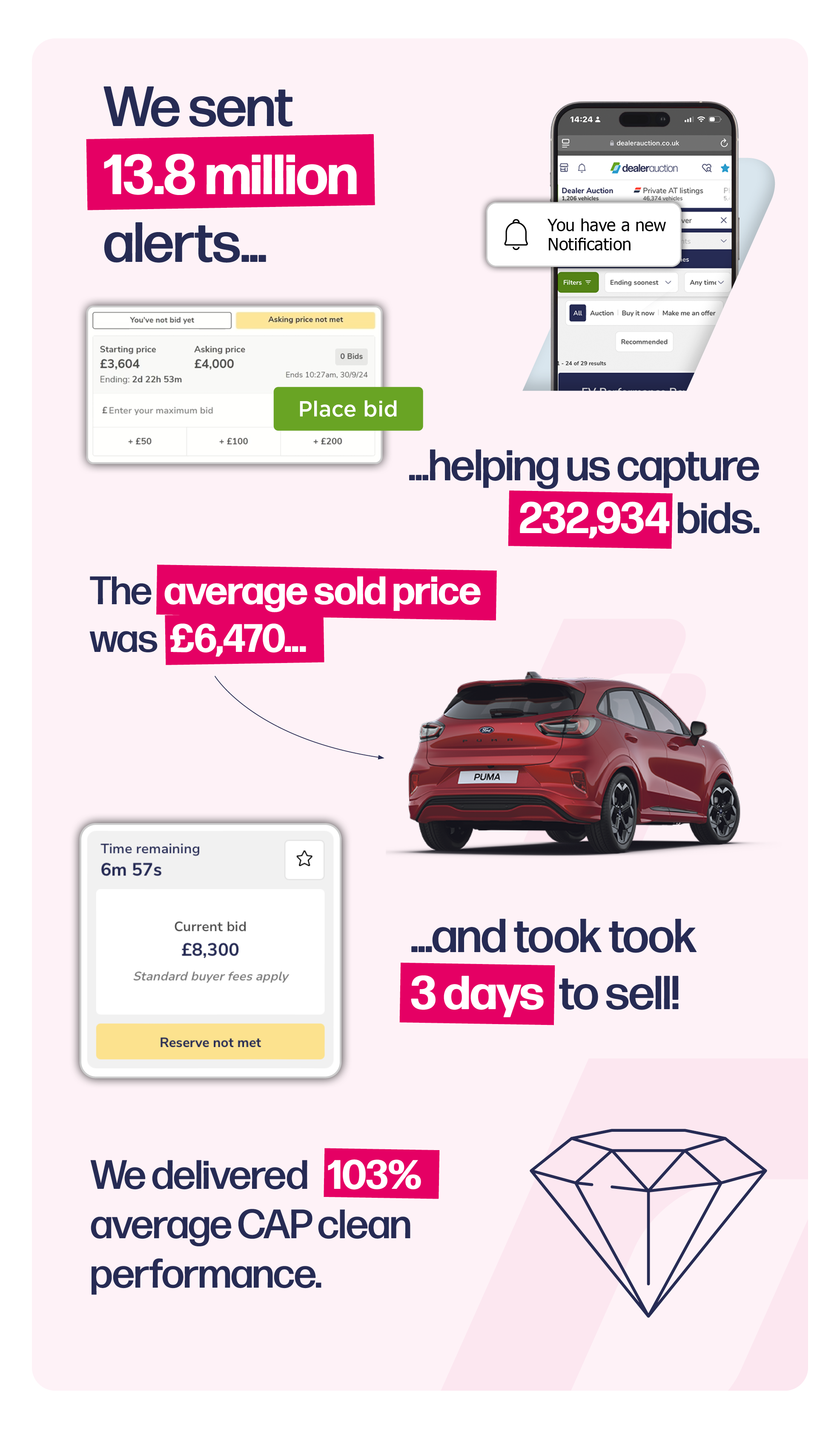

A whopping 13.8 million intelligent stock alerts flew across the airwaves in Q3 2025 – more than double those sent in Q2 (5.7 million) and quadruple those sent in Q1 (3.2 million).

And that’s not the only area of our statistic dashboard that flashed green, as we saw huge successes when compared to Q2 2025 and the same quarter in 2024. We saw 45,396 auctions ending in Q3 2025 – up 11.2% from Q2 (40,839) and up 22.4% from Q3 2024 (31,688). We also saw 232,934 total bids captured on our platform, rising from 223,551 in Q2.

Our average CAP Clean performance nudged ever higher, from 102% to 103% – we’re setting our sights on Q1’s 105% for Q4! The average sold price slightly dipped from £6,705 in Q2 to £6,470, but it was notably up on Q3 2024.

Total retail value of vehicles hits £145m

The total retail value of vehicles traded through our platform between 1 July and 30 September 2025 grew from £136,071,047 to £145,291,147. The £2.9 million trade profit generated for sellers signalled a fall from Q2’s £3.3 million, but was still a strong showing.

High mileage, higher demand

Middle-aged vehicles were in the spotlight, with the average age rising from 7.8 years to 8.5 and average mileage rising from 62,281 to 71,28. Proven on the road but far from retirement, they’re ready for the next adventure.

Looking at fuel-type breakdown, petrol accounted for 53.9%, followed by diesel (39.7%), bi fuel & hybrid (5.2%) and EV (1.1%). We sold vehicles ranging from £50 to £128,000, with a Mercedes-AMG GT coupé zooming through the platform.

Volvo seeking pole position for profit

When it comes to CAP Clean performance, the top performer in Q3 was the Jaguar XF with a CAP Clean performance of 110.8%, followed by the BMW 3 Series (102%). Regular top-performer, the Vauxhall Mokka, held its third-place spot from Q2.

Premium models once again dominated the retail margin chart. The Land Rover Discovery Sport retained the top spot with an assumed gross margin of £3,950, while the Range Rover Evoque (£3,431) was pushed into third by the Volvo XC90 (£3,744). Having toppled one Land Rover, will the XC90 hit the top spot next quarter? Watch this space…

What’s the story? Q4 glory

As we cruise into the final quarter of 2025, the road ahead looks anything but quiet. Stock levels, pricing and buyer behaviour continue to evolve – and those ready to adapt will be the ones crossing the line first. With Dealer Auction’s data-driven insights and smart stock tools in your corner, there’s every opportunity to finish the year strong.

The UK’s smartest digital wholesale marketplace

Like what you see? Why not take us for a 30-day test drive…