Used cars continue to boom

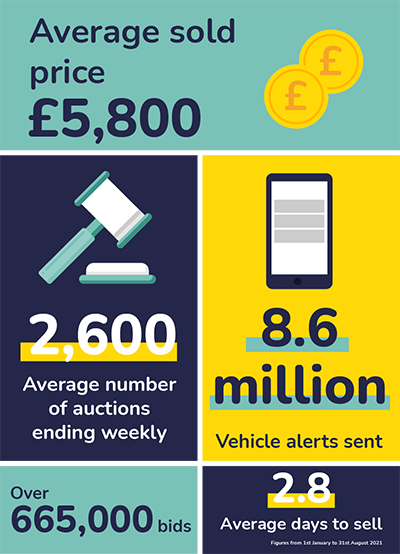

On average we have over 2,500 auctions ending every week! Having such a vast choice of stock has received an overwhelming response from buyers, who have placed a whopping 665,000 bids! This reflects the current appetite for used vehicles, with the global supply shortage of new vehicles set to continue for some time yet.

Supply and demand

In the Q3 2021 edition of their AutoFocus magazine, Cox Automotive noted that ‘days in stock’ for many dealers are currently as low as 22 days, compared to an average of 59.7 and a benchmark of 45 days – highlighting the current level of retail demand for used cars.

Dealers are considering different stock profiles – retailing much older and higher mileage stock (more on that later!). Our platform’s seeing huge demand, with vehicles taking just 2.8 days to sell on average. This means that dealers are potentially selling their wholesale vehicles before they would normally be collected by a traditional auction centre.

This is great news for sellers, as being able to get vehicles on sale as soon as they are inspected and imaged is key to ensuring a quick sale and cash back in the bank.

The need for speed

With this unprecedented demand for quality stock, dealers are harnessing the power of digital to stay ahead. We’ve sent out over 8.6 million alerts so far this year, matching the right stock to the right buyers! With buyers being notified the instant a vehicle they’re looking for hits the platform, could you be missing out on the stock you need? Or even, missing out on your stock being sent to thousands of engaged buyers?

Data is king

It’s all about buying and selling smarter. Plus, being able to make decisions quickly and confidently – especially in the current market conditions.

For buyers, this means you can bid on vehicles with the confidence of knowing you can shift it quickly and profitably. For sellers, you can swiftly identify and remarket stock that isn’t right for your area, and benefit by widening your buyer pool to an area where the vehicle is in demand – in short, this means dealers will pay more!

Prices on the rise?

Another trend that’s hit the headlines is the rise in used car prices. Our average sold price has increased by 15.5% to £6,700 in August; compared to the average across the first 6 months of the year. Which is just under the 16.6% used car prices reported earlier this month.

According to a Cox Automotive survey, 96% of dealers have changed their stock profile strategy as a direct result of the pandemic and supply constraints, and are retailing stock with higher age and mileage. We expect to see this trend continuing while new car stock issues persist.

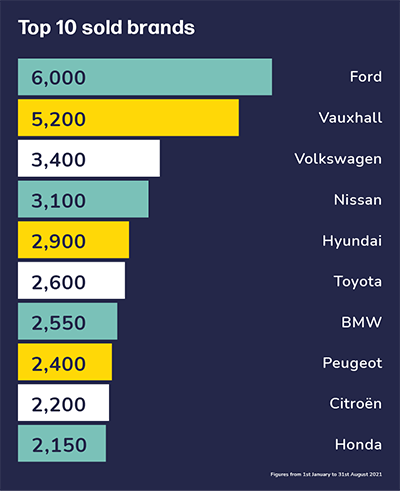

Movers and shakers

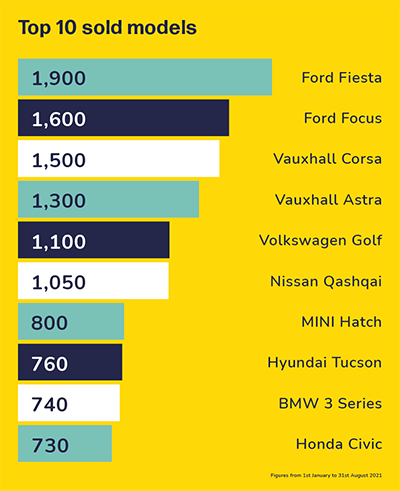

Our current top 10 models list provides further interesting industry insight – it’s dominated by smaller cars, which supports the recent consumer trend of shunning public transport and car sharing, due to fears over the pandemic.

Eyes on the horizon

So, what can dealers do to help inform their stock-buying strategies moving forward? Here are the key take-aways:

- Be agile in your approach to sourcing stock and harness the power of digital.

- Use real-time data to support your instinct and make smarter and quicker decisions.

- Sign up to instant stock alerts to let the right stock find you.

- Dispose of your unwanted stock quickly and profitably – and free up that all-important forecourt space for cars that perform in your area.

With used cars ruling the roost, it’s all about getting hold of the used car stock you need right now and pricing it correctly for retail. At Dealer Auction, we’re here to give you all the tools to be as profitable as possible – whether you’re buying or selling. We’re with you every step of the way!