Q4 is routinely a quiet time for automotive, where seasonality and the holiday period typically make for slower sales. However, the trend was well and truly bucked on the UK’s leading remarketing platform as we saw more than 33,000 auctions end between 1st October and New Year’s Eve, the most of any quarter last year.

’24 and there’s so much more

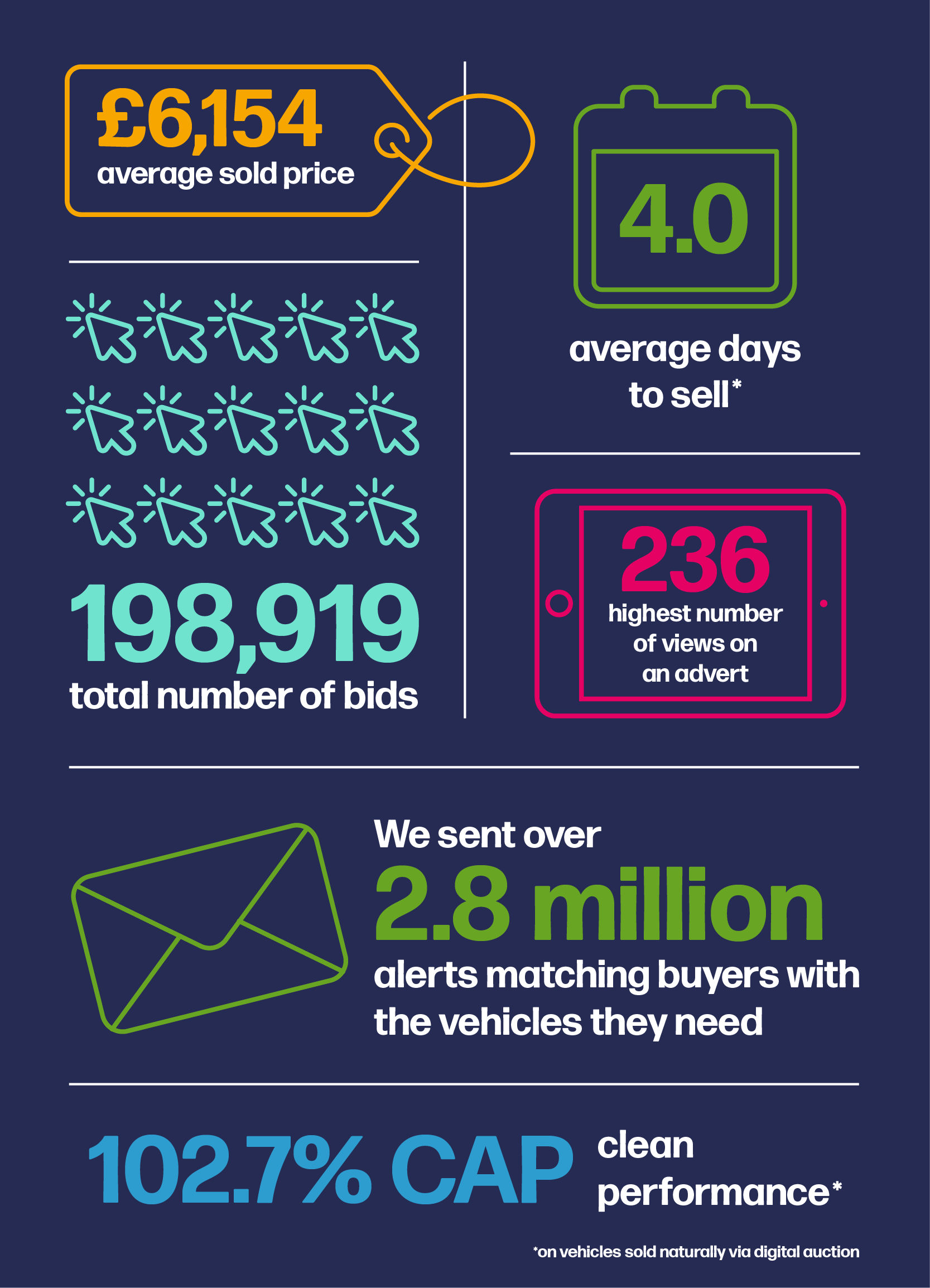

We continued to match buyers with the vehicles they need by sending more than 2.8 million alerts. That’s only a slight drop on the previous quarter and a remarkable figure, considering the time of year. The jaw-dropping number of auctions ended (33,012 to be exact) is proof of the incredible choice customers have on Dealer Auction. Big wins for customers look set to continue in 2024, as we have plans to add even more consumer motors to the platform over the next 12 months.

Solid CAP clean and more good news

The average sold price on our platform stayed generous in Q4, clocking in at £6,154. The average days to sell, at 4.0, was a non-mover from the previous quarter. Again, a quieter time of year, but all evidence continues to prove that digital hasn’t shifted from its rightful place of being faster and more efficient than traditional remarketing options. Dealer Auction’s CAP clean performance remained solid in Q4 at 102.7%. Like a postman who can’t be stopped, Dealer Auction continues to deliver.

Dropping age and mileage

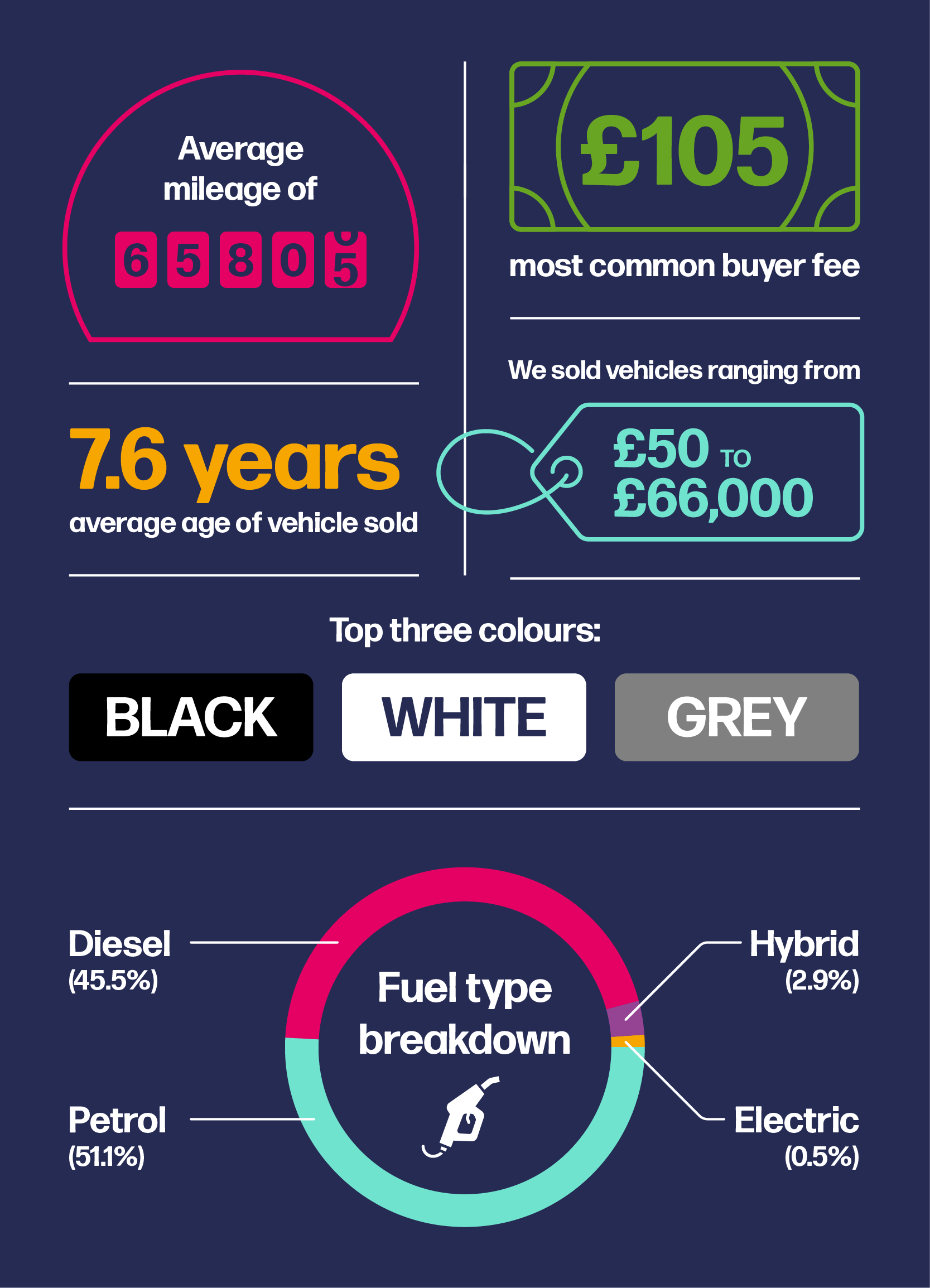

The average age and mileage of vehicles bought and sold through Dealer Auction continued to tumble – a trend that characterised our platform throughout last year. The former stood at 7.6 years in Q4, while the latter was an encouraging 65,805. As stock supply improves, we are seeing more and more younger models enter the digital wholesale arena. The choice on offer is underscored by the fact that we sold vehicles ranging from £50 to £66,000.

EV: Charging ahead

Figures collated on Dealer Auction show that the level of EV and hybrid activity on the platform continued to rise throughout the year. By the end of Q4 2023, we saw a 58% increase in the number of AFVs listed compared to 2022. That jump highlights the slow but unstoppable shift towards cleaner motoring, as more and more of these vehicles enter the used market.

Margin onwards with LCVs

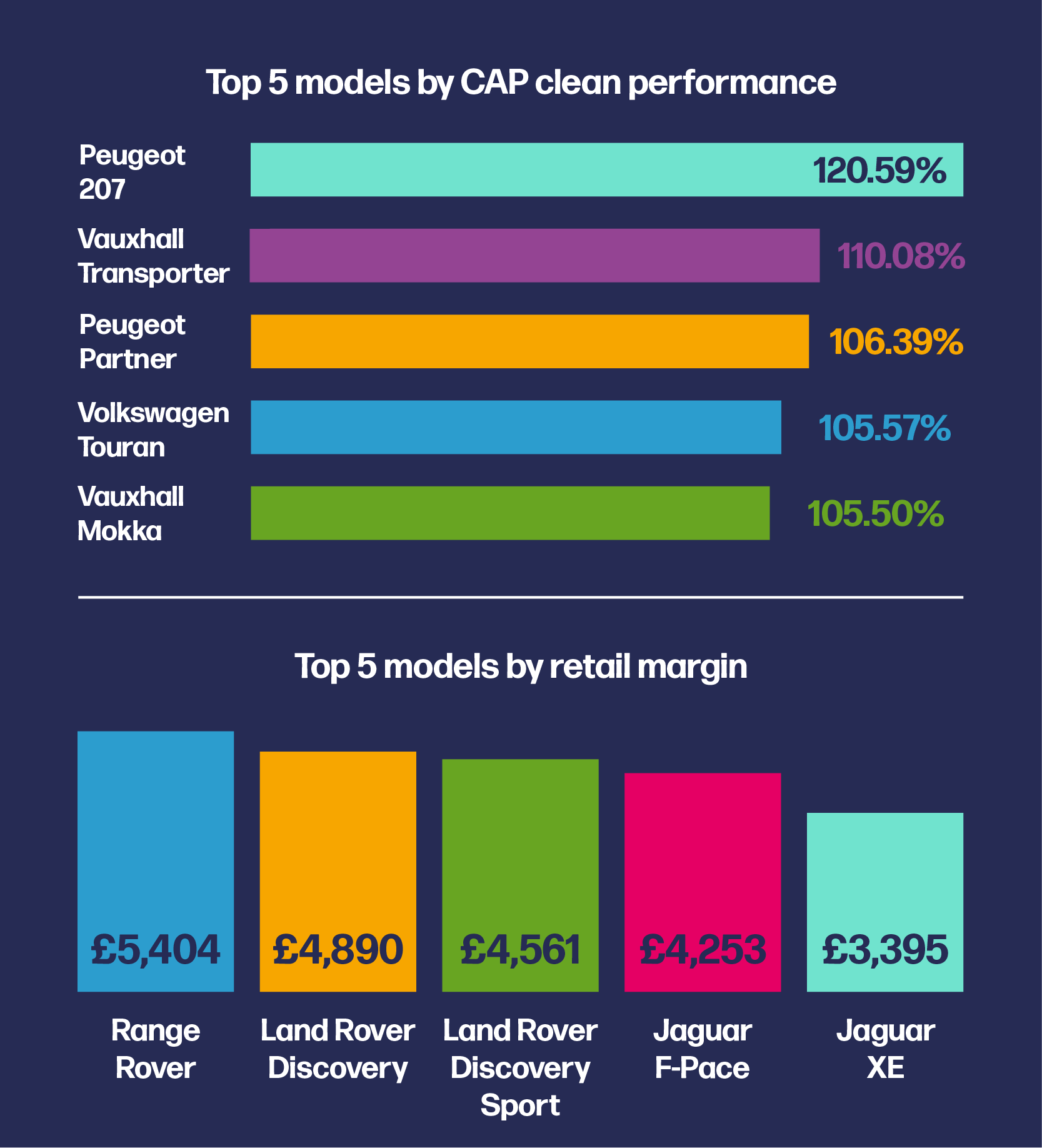

Another notable change in Q4 2023 on Dealer Auction has been the strength of the CV market. Two of the top five models (by CAP) were vans. That’s the first time all year that any van has made the list.

In terms of brand popularity, JLR dominated our retail margin table in Q4. Range Rover Evoque has moved to the top of the list and increased its margin compared to Q3. That’s a trend we’ve seen across the board. New entries to the table include Jaguar with the F-Pace and XE.

Just look at the numbers

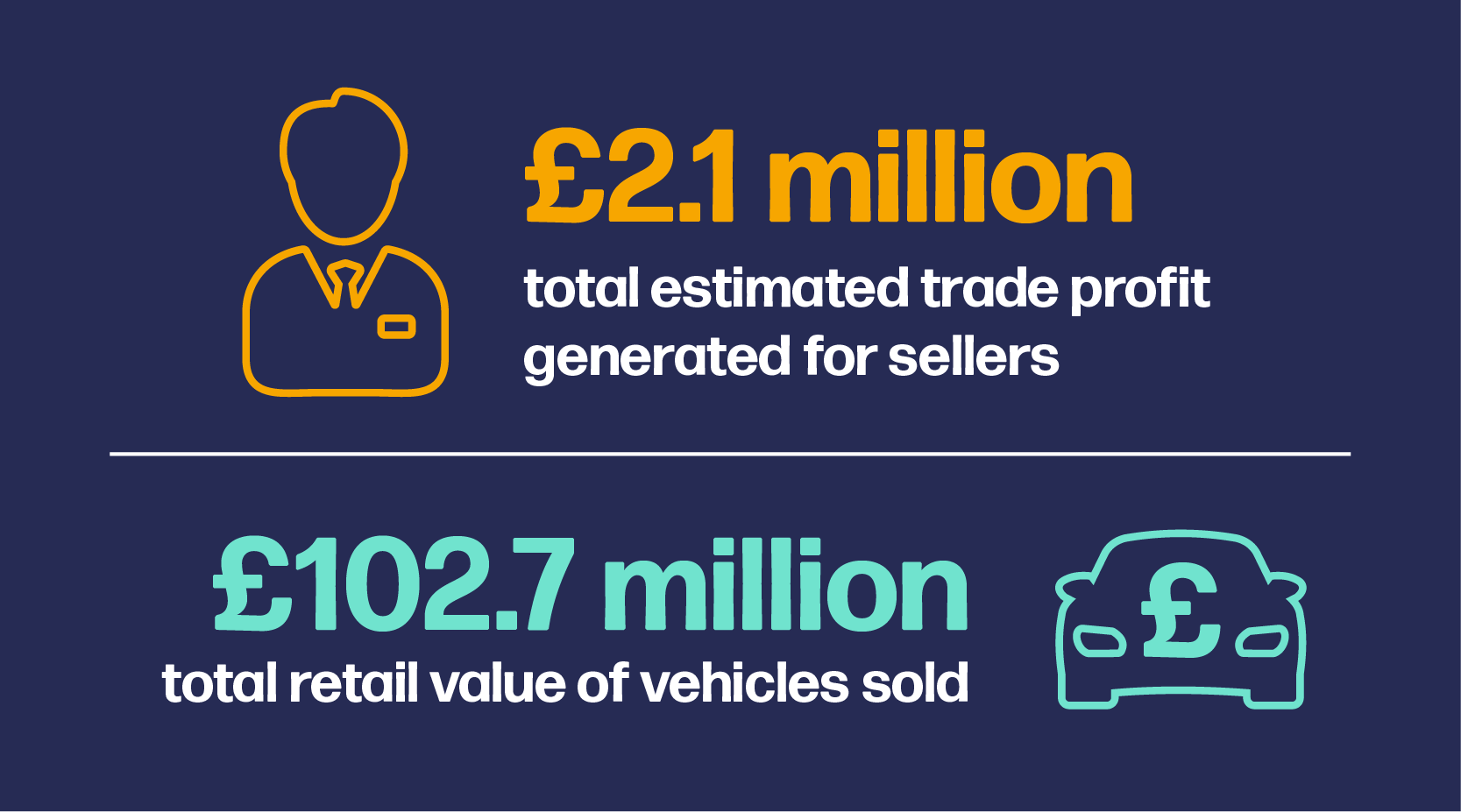

We continued to support the dealer market throughout the year by providing choice, convenience and confidence. With more than half a billion pounds in estimated retail value sold through the platform and £12.5 million trade profit generated for sellers, the numbers speak for themselves.

The UK’s smartest digital wholesale marketplace

It’s clear to see that Dealer Auction makes buying and selling used vehicles easier and more profitable for everyone. Backed by unique data insights and clever tools, we help you make the best decisions.

Sound good? Why not sign up for a free 30-day trial?