August 2022 – Data from our monthly Retail Margin Monitor has revealed six new entries in the top 10 manufacturers for July, and meanwhile the top 10 makes see a new-entry Subaru in the number two spot.

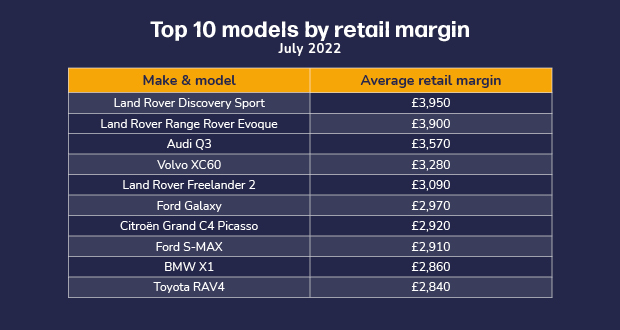

Land Rover models place first and second in the top 10 table this month, with the Discovery Sport (£3,950) and Range Rover Evoque (£3,900), respectively – closely followed by the Audi Q3 with an average retail margin of £3,570. However, despite the reappearance once again of Land Rover models at the top of the table, a considerable 60% of the top 10 models from July are new table entries.

The Ford Galaxy (£2,970), Citroën Grand C4 Picasso (£2,920) and Ford S-MAX (£2,910) sit comfortably in the middle of the table, with just a £60 average range differentiating their retail margins. This appearance of non-luxury brands is significant, as recent months have seen a recurrence of premium and luxury brands filling up the majority of the top 10s. Furthermore, due to July seeing the start of the school holidays, the popularity of these more affordable family MPVs is not surprising.

Dealer Auction’s Marketplace Director Kieran TeeBoon commented:

“We’re seeing a consistent trend in the brands appearing in the top 10 marques month to month – each time reaffirming that these are the makes you want to stock to ensure high profits – while Subaru’s table entrance also acts as a reminder to keep a diverse stocklist, and never forget the underdog.”

Looking at the data on a brand level, a remarkable 90% of the marques remain the same as the previous month – a solid indicator that these brands are still proving popular for dealers. Though the brands remain the same and Land Rover continues to hold its top spot with an average retail margin of £3,860, the rest of the table has seen significant movement.

Subaru has entered the table for the first time and jumped straight to an impressive number two spot, with an average retail margin of £3,150. This sudden piqued interest could largely be due to ‘Subaru’s ongoing supply chain issues’ which are ‘affecting new model sales’1.

TeeBoon concludes:

“Our most recent data has showcased a number of models and makes proving popular that we haven’t seen thus far. Because of this, the used car market can seem unpredictable – but our platform can help you diversify your stocklists proactively, with real-time market data”

Auto Trader’s Data and Insight Director, Richard Walker, commented: “At a time when the market is moving at a record pace, it has never been more important to base your pricing and forecourt strategy on data. By not doing so, you not only risk losing vital profit, but also losing the sale altogether.”

About Dealer Auction

Dealer Auction is the UK’s smartest and busiest automotive digital wholesale marketplace. We give buyers and sellers more choice, better insight and greater margin. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the highest margins seen on used vehicles with a significant number of units sold under the £25,000 retail mark, sold on the platform’s open network the previous month. The June 2022 edition analyses data from 1 to 31 July 2022.

Sources:

1 https://plc.autotrader.co.uk/press-centre/news-hub/fastest-selling-used-cars-june-2022/