At a glance:

- Hatchbacks claimed top profit spots, led by the Renault Clio.

- SUVs like the Peugeot 2008, Nissan Qashqai and Land Rover Discovery Sport continue to perform well, but no longer dominate margins.

- New ‘Best Buy’ metric identifies MG ZS and Nissan LEAF as hidden gems for profit, speed to sale and competitive pricing.

- Dealers must rethink stock as the pandemic stock shortage impacts older cars.

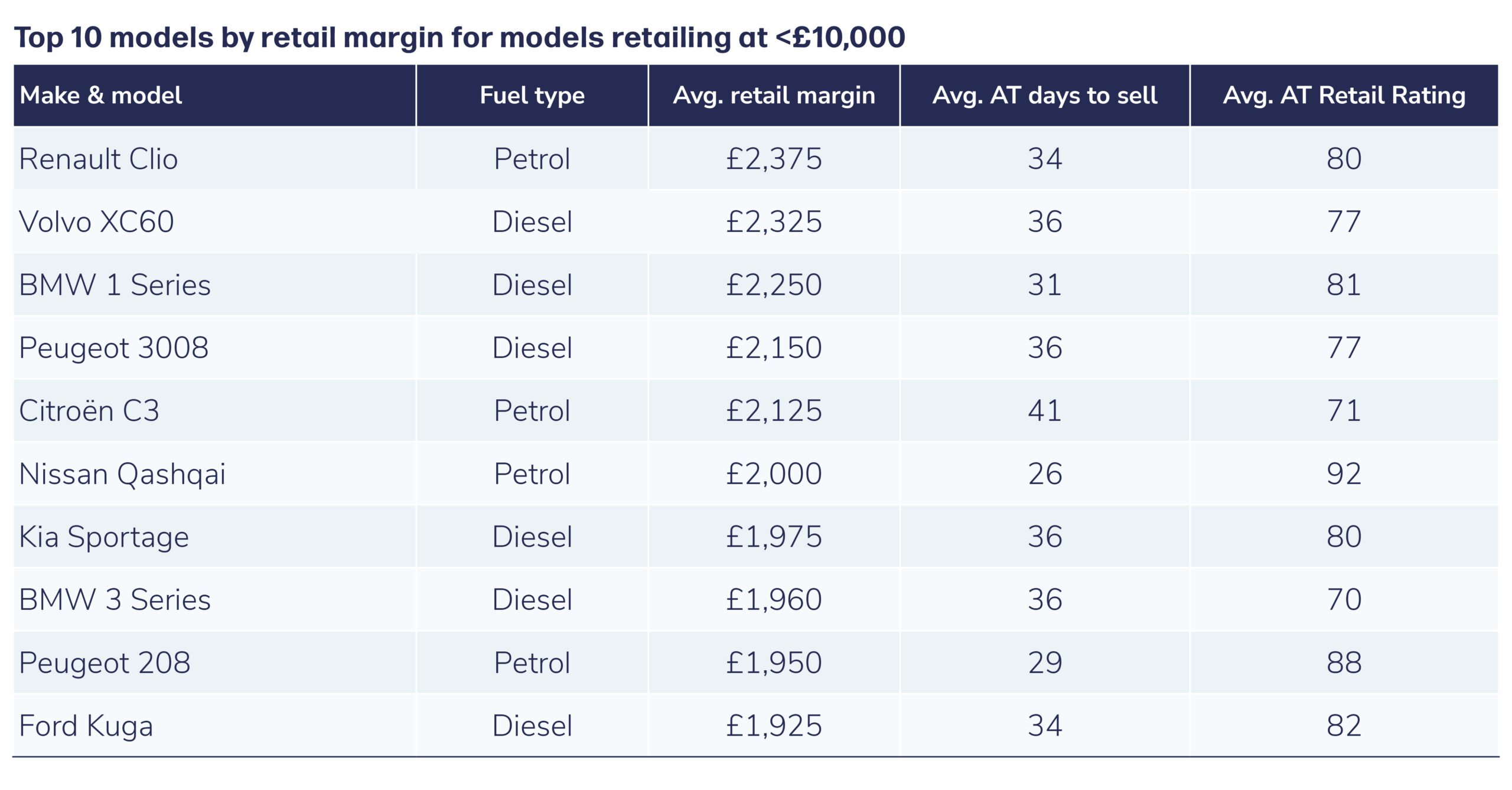

February 2026 – The latest Retail Margin Monitor from Dealer Auction has revealed a big shake-up in the used vehicles providing the top profits for dealers. A new-entry hatchback took the crown in the sub-£10,000 retail bracket for the first time: the petrol Renault Clio. It was joined by fellow hatches, the diesel BMW 1 Series in third and the petrol Peugeot 208 – another fresh entry – in ninth.

This shift from SUV domination began in December 2025, which saw new entries from hatchbacks like the Ford Fiesta, Vauxhall Astra and Volkswagen Polo – albeit appearing further down the top 10. Compact models also disrupted the over-£10,000 retail bracket in January 2026, with new entries from the Vauxhall Corsa, Hyundai i10 and i20 helping the hatches take 40% of the model share.

Dealer Auction’s Marketplace Director, Kieran TeeBoon, commented: “After spending months in the shadow of SUVs, hatchbacks are back! Their profit performance will be food for thought for dealers, as competition for quality stock intensifies. It certainly shows how fast today’s market is moving – dealers can’t just rely on last year’s top performers!”

Although they didn’t dominate, SUVs still performed well. The Peugeot 2008 – 2025’s top profit-maker – secured the fourth spot. Meanwhile, the Nissan Qashqai continued its strong profit performance in both retail brackets, as well as proving a speedy seller, shifting in 26 days on average. The Land Rover Discovery Sport, Hyundai Tucson and Volkswagen Tiguan ruled the over-£10,000 bracket, with the Discovery Sport being the top performer with an average margin of £3,990.

Dealer Auction’s new ‘Best Buy’ metric identified the MG ZS as the top hidden gem in the sub-£10,000 retail bracket for January 2026, while the all-electric all-star Nissan LEAF was one to watch. The metric uses a unique formula to compare the key metrics of trade price, estimated margin and speed to sale to identify the top performers across the board.1

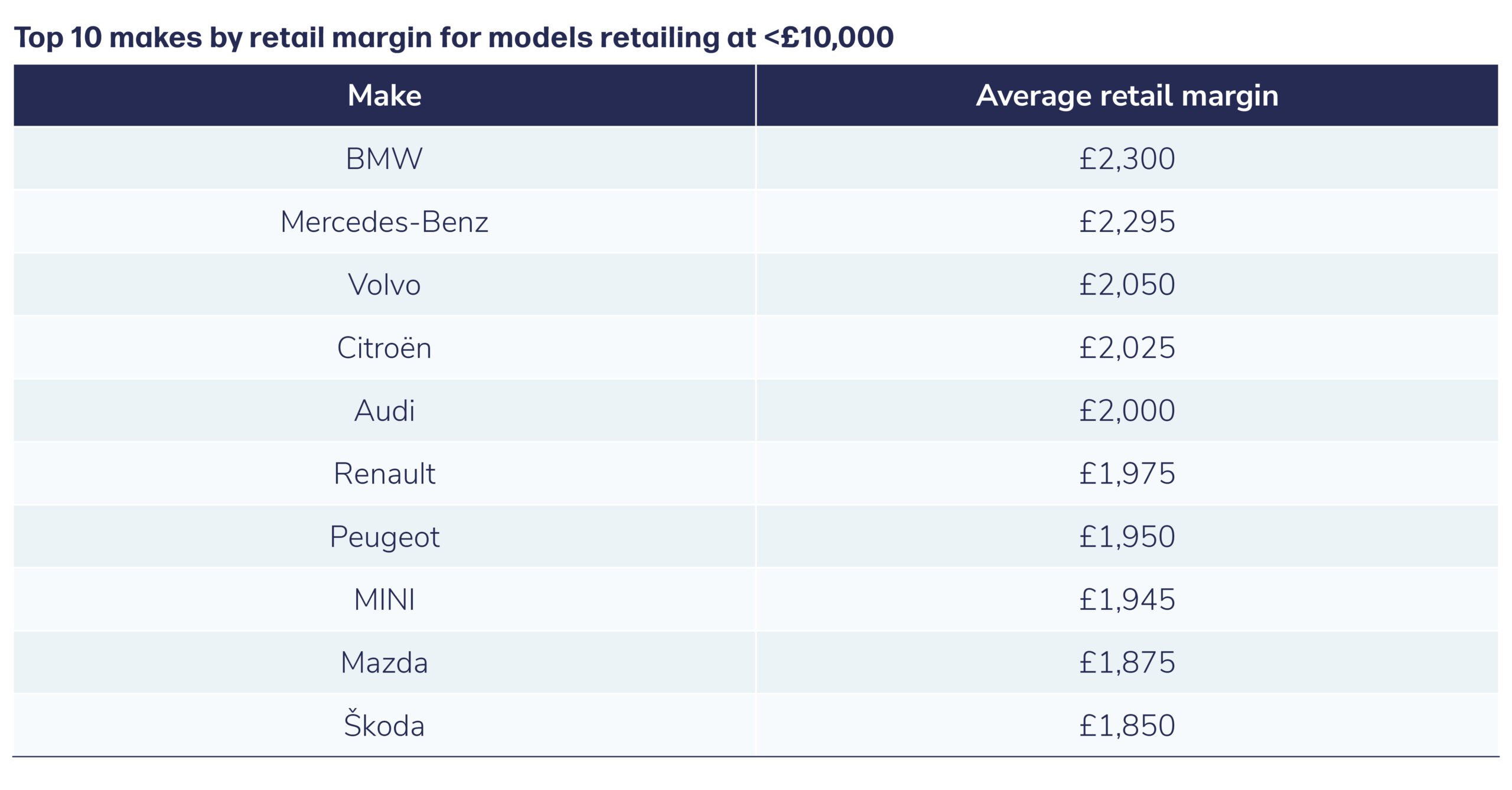

At brand level, BMW took the crown in the top 10 makes for models with a retail value of under £10,000, followed by Mercedes-Benz and Volvo. Notably, Land Rover dropped out of the chart, having topped it for the past six months – although it still commanded the premium retail segment, retaining the top spot of the over-£10,000 chart for the 13th consecutive month.

Dealer Auction has enjoyed a strong start in 2026. The UK’s smartest digital marketplace boasted the highest monthly total retail value of vehicles sold, at £46 million. And, as well as opportunities for buyers to find unique avenues for profit, January was also a good month for sellers. The estimated trade profit generated during the month also hit a record monthly high of £1.6 million.

The UK used car market similarly enjoyed a strong start to the year, but there are challenges afoot. Five- and six-year-old cars are about to see a drop of between 25% and 30% this year, Autotrader’s Marc Palmer recently warned at Car Dealer Live.2

The resulting gaps will force dealers to move out of their comfort zones and rethink stock age, fuel type and models, says TeeBoon. He concluded: “With so many different forces at play, it’s no time to be complacent. Dealers – particularly independents who build their business on second and third-owner vehicles – are having to use all their experience and knowledge, as well as the data that’s available to them, to embrace these evolving market dynamics.”

Take us for a test drive.

Curious about what you see? Then why not try Dealer Auction for free for 30 days?

Sources:

1How we calculate Best Buy:

Best Buy highlights the vehicles that offer the strongest buying opportunity on the platform. We rank vehicles based on three factors: how competitively they’re priced against CAP Clean, the average retail margin between the sold price and the Autotrader retail valuation, and how quickly they sell at retail. This means our Best Buy focuses on vehicles that are well priced, deliver solid margins and turn over quickly. To keep the data robust, only vehicles with at least 10 sales in the month are included.

2Autotrader (2025). UK car market set to finally return to pre-pandemic scale as 10m transactions predicted for 2026. Available at: https://plc.autotrader.co.uk/news-views/press-releases/uk-car-market-set-to-finally-return-to-pre-pandemic-scale-as-10m-transactions-predicted-for-2026 (Accessed: 11 January 2026).

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Autotrader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £10,000 (we also track any standout models that retail at more than £10,000). We then compare the sold price for each model with the Autotrader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold of models retailing at less than £10,000. We crunch the numbers at the start of every new month.

This edition analyses data from 1 to 31 December 2025 for the monthly analysis. The yearly analysis data from 1 January to 31 December 2025 uses unit parameters of 250 for models and 500 for brands.