The second quarter of 2023 has seen a typically optimistic performance from Dealer Auction, despite the traditional time-of-year slowdown. In summary, it’s been quite the quarter!

Strength in numbers

Despite the customary calming of the market, we usually experience in the second quarter, we witnessed a 21% increase in the number of auctions ending. This saw us push out 800,000 additional stock alerts, instantly notifying dealers that the stock they’re looking for has been added to the platform.

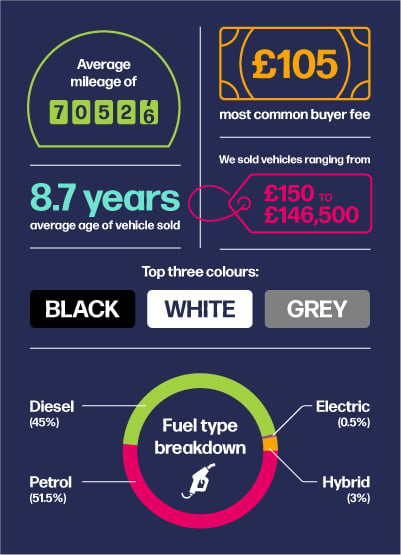

There was a slight easing in the average sold price compared to the first part of the year (from £7,680 to £7,202), a CAP clean performance* that was slightly less but still very strong at 103%, and a lift in days to sell (to 3.8 days). Again, this was expected with holidays impacting both the wholesale and retail markets but highlights how the digital route is noticeably swifter than traditional remarketing options.

More than a quarter of a million bids (and counting)

The increasing number of stock sources and volume from manufacturers, dealers, fleets, auctions, and consumers generated 251,000 bids across the open network. Relevant vehicle and market data local to postcode ensures that our large base of active buyers can bid strong and fast.

Stock choice is the name of the game

The profile of stock has remained remarkably consistent in Q2 compared to Q1, with very small changes in the average mileage and age of vehicles listed. However, it would be amiss to think this is the only type of stock you can get on Dealer Auction. Dealers have bought vehicles ranging from £150 right up to £146,500 – now that’s choice!

What’s more, our most common buyers fee was just £105, meaning dealers are not just using Dealer Auction to find the right vehicles for their forecourt, but they are also reaping the benefits of low costs and greater margins.

Not everything is black and white…

… Sometimes it’s grey! The top three most prevalent colours of vehicles sold on Dealer Auction in Q2 were black, white and grey. That was also the case in Q1, highlighting, as it were, a colour consistency.

A fleeting glance at any traffic queue tells you that Teslas and their ilk are here to stay and with the UK’s leading EV subscription service, Onto, launching an exclusive closed network on the platform, it won’t be long before EVs are taking a bigger slice of the pie.

Four-wheel thrive

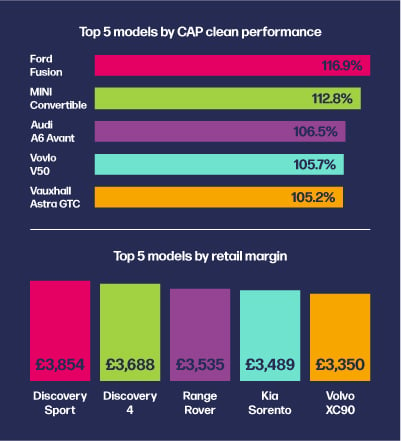

By comparing the average sold price of models on Dealer Auction with the average retail price on Auto Trader we can see that large 4x4s are generating the biggest margins for dealers. Topping the list is the intrepid Discovery Sport (£3,854), followed by its sister model the Discovery 4 (£3,688). Also in the top five are the Range Rover (£3,535), the seven-seater Kia Sorento (£3,489) and the timelessly stylish Volvo SC90 (£3,350).

For the second quarter of 2023, big remains beautiful (and profitable). However, when looking purely at trade sales it’s interesting to see the Mini Convertible second in the table with a CAP clean performance of 112.8%.

You can keep track of the vehicles that are making the biggest estimated retail margin, fastest days to sell and highest Auto Trader Retail Rating with our monthly Retail Margin Monitor.

Digital driving results

As reported in Q1, 2023 continues to be a year that’s seen the return of normal market cycles. Refreshed by improving vehicle supply and strong demand levels, the change is clear on Dealer Auction despite economic challenges. With auctions ending every few minutes, low buyer fees and exceptional stock performance it’s no surprise that Dealer Auction remains as busy as an oversubscribed bee convention.

The UK’s smartest digital wholesale marketplace

Dealer Auction is all about making buying and selling used vehicles easier and more profitable for everyone. We’re backed by unique data insights and clever tools that help you make the best decisions.

Sound good? Why not sign up for a free 30-day trial?