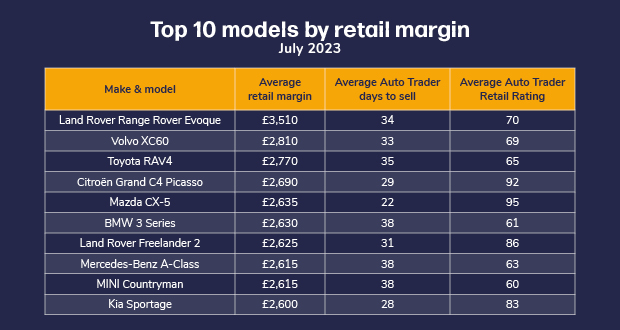

August 2023 – Data from Dealer Auction’s latest Retail Margin Monitor has revealed three new high-performing mainstream entries. While Land Rover’s Range Rover Evoque retained its number one position in July, with an average retail margin of £3,510, the Citroën Grand C4 Picasso people-carrier, Toyota RAV4 SUV and Kia Sportage SUV’s impressive retail margins secured each a place in the top 10.

The Grand C4 Picasso stood out with an average Auto Trader days to sell of 29 and Auto Trader Retail Rating1 of 92 – making it the third fastest-selling and second highest-rated model in July’s league table. The Kia Sportage also made its first-ever appearance in the top 10, taking the tenth spot for average retail margin, with an average days to sell of 28 – making it the month’s second fastest-selling model .

Dealer Auction’s Marketplace Director, Kieran TeeBoon, commented:

“The arrival of three affordable family cars this month may well be down to the summer break and families swapping their cars for something better suited to a week by the seaside. Our league table once again demonstrates why staying up to date with consumer trends like these has its benefits and can help dealers make educated predictions about the stock their customers are looking for. Basically, how to make high-profit sales as fast as possible.”

Last month’s fastest-selling profit-turner, the Mazda CX-5, has held onto the crown for yet another month, with an average days to sell of 22 in July. It also scored the highest AT Retail Rating of 95.

At brand level, Land Rover and BMW held onto the number one and two spots, with average retail margins of £3,580 and £3,000 respectively. After dropping out of the top 10 makes last month, SEAT is back in the number 10 spot with an average retail margin of £2,133. Citroën appears just outside the brand table at number 11.

TeeBoon concluded: “We can speculate that Citroën’s position at brand level – so close to the top 10 – will have been greatly affected by the Grand C4 Picasso’s high sales margin and rating in July. If anything, this is a reminder to consider all factors, including average margins, the Auto Trader Retail Rating and average days to sell, when seeking out the best profit opportunities.

“And if we circle back to the Mazda CX-5, it’s the perfect example of using the available tools to identify potential top-selling models before the month even begins – helping dealers fill their forecourt for profit.”

Richard Walker, Director of Data & Insights at Auto Trader, the UK’s largest online automotive marketplace, commented on the RMM:

“Supply is slowly beginning to return to the used car market and we’re seeing high levels of demand absorbing this with visits to Auto Trader up 17% on 2022 in July. With good use of data, cars sell quickly. We’re seeing cars aged 5-10 years sell in just 28 days and solid demand is also reflected in the volume of used car transactions, up over 4% on Q2 2022. These market dynamics mean there’s plenty of profit opportunities out there for retailers who stay close to the data.”

ENDS

About Dealer Auction

Dealer Auction is the UK’s smartest and busiest automotive digital wholesale marketplace. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £25,000. We then compare the sold price for each model with the Auto Trader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold. We crunch the numbers at the start of every new month. This edition analyses data from 1st July to 31st July 2023.

Notes:

1 The average ‘Auto Trader Retail Rating’ uses three key metrics to determine the consumer demand for the vehicle:

• Average days to sell – Calculated for the whole of the UK and then adjusted for the variations Auto Trader have observed locally in your area.

• Live market supply – Comparing the national supply level for the vehicle over the last seven days with the usual level of supply Auto Trader have seen in the market over the last six months.

• Live buyer demand – Analysing how many people are currently searching for the vehicle on Auto Trader, comparing consumer search behaviour over the last seven days against the level of interest over the last six months.