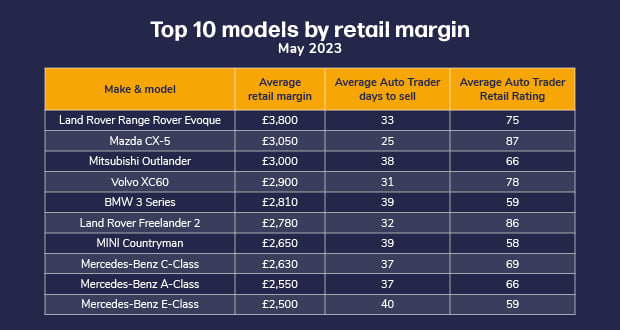

July 2023 – Data from Dealer Auction’s latest Retail Margin Monitor has revealed that the Mazda CX-5 was the quickest seller again in June and moved from ninth to second in the table for average retail margin, jumping from £2,605 to £3,050.

Mercedes-Benz was also a key player, with three products appearing in a row. The C-Class coupé, A-Class hatchback and E-Class saloon – stood out in a table historically dominated by SUVs.

Dealer Auction’s Marketplace Director, Kieran TeeBoon, commented:

“June’s results were a resounding triumph for premium models, but it’s interesting to see trends within the top 10 itself. The recent performance of the Mazda CX-5 makes it one to watch! Plus, the spread of Mercedes-Benz models is a prime example of the importance of looking at all of the information available in order to stack the odds in your favour and satisfy consumer demand.”

Elsewhere in the table, the Range Rover Evoque claimed the top spot with an average retail margin of £3,800. Notably, this was the first month where the consistent top performer, the Land Rover Discovery Sport, didn’t appear – but Dealer Auction explains this is down to it not meeting the Retail Margin Monitor’s criteria of units sold.

At brand level, Land Rover once again topped the chart with an average retail margin of £3,630, followed by BMW (£2,800) and Volvo (£2,720). Unlike the top 10 models, the brand table saw four mainstream brands achieve high margins: Nissan, Kia, Volkswagen, and new entry, SEAT.

TeeBoon concluded:

“With so many different forces at play in the used car market, it’s more important than ever to be on top of changing consumer demand. This is highlighted in the data from our top 10 makes – SEAT has only appeared in the top 10 once before and Kia only three times, so these are unique opportunities for solid profit.”

Richard Walker, Director of Data & Insights at Auto Trader, the UK’s largest online marketplace commented on the Margin Monitor: “The recent rise in retail values has done little to dampen consumer demand, reflected in the very strong levels of engagement we’ve seen on our marketplace. The fluctuation shown in Dealer Auction’s figures not only highlights just how fast-paced the market is right now, but also underpins the importance of taking a data-led approach to stocking and pricing decisions.”

About Dealer Auction

Dealer Auction is the UK’s smartest and busiest automotive digital wholesale marketplace. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £25,000. We then compare the sold price for each model with the Auto Trader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold. We crunch the numbers at the start of every new month. This edition analyses data from 1st June to 30th June 2023.

Notes:

1 The ‘Average Auto Trader Retail Rating’ uses three key metrics1 to determine the consumer demand for the vehicle:

• Average days to sell – Calculated for the whole of the UK and then adjusted for the variations Auto Trader have observed locally in your area.

• Live market supply – Comparing the national supply level for the vehicle over the last seven days with the usual level of supply Auto Trader have seen in the market over the last six months.

• Live buyer demand – Analysing how many people are currently searching for the vehicle on Auto Trader, comparing consumer search behaviour over the last seven days against the level of interest over the last six months.