April 2024 – Data from Dealer Auction’s latest Retail Margin Monitor has revealed that products from both premium and mainstream brands offered dealers opportunities for profit in March 2024. A new entry from Peugeot emphasises the importance of holding a varied stocklist.

While the model chart was again dominated by premium brands, the brand chart saw three mainstream brands feature: Honda, Kia and Peugeot. Newcomer Peugeot attracted an average retail margin of £2,000.

Dealer Auction’s Marketplace Director, Kieran TeeBoon, commented: “March saw some movers and shakers at brand level, with Peugeot entering the fray for the first time. These monthly shifts are important for dealers who are keen to make quick and smart stock decisions.”

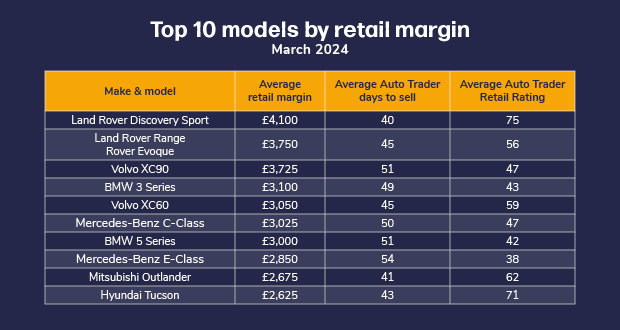

At model level, it was very nearly a clean sweep for premium products, with the Land Rover Discovery Sport, Range Rover Evoque and Volvo XC90 at first (£4,100), second (£3,750) and third (£3,725) respectively. Regular top performer, the Discovery Sport, also topped the chart for being the fastest seller and highest Average Auto Trader Retail Rating.1

Re-entries for the BMW 5 Series and Volvo XC90 meant that there were two models apiece for Land Rover, BMW, Volvo and Mercedes-Benz.

The sole mainstream model, the Hyundai Tucson – which joined the chart last month – was still present, albeit in the tenth spot. However, it shouldn’t be overlooked, as TeeBoon notes:

“It’s clear that dealers are finding strength in data-driven decisions to back up their instincts. The performance of the Tucson indicates dealers are keen to get ahead of the game by locating practical, family-friendly vehicles for the summer. Although it appears further down the margin chart, it’s the third-fastest seller and has the second-best Average Auto Trader Retail Rating.

He concludes: “Data is a powerful tool for dealers to wield. Smart stock decisions aren’t just choices; they’re strategic manoeuvres that drive success.”

Richard Walker, Data and Insight Director at Auto Trader commented: “Despite an uncertain economic and political backdrop, we’ve seen a positive start to 2024, with demand remaining robust throughout the quarter and a record 89.1 million visits to Auto Trader in March and that’s reflected in the margins on display in Dealer Auction’s Margin Monitor. Right now, retailers face a nuanced and complex market which will continue to move at pace but our outlook is confident for the rest of the year.

“As the Monitor mentions, to navigate the market and to identify both future opportunities and risks, data is key. We’ve recently made more of our data available than ever before. Our valuations data alone was used over 240 million times last year, around 100 million more times than 2022, showing just how powerful it’s been in informing key retail decisions.”

Take us for a test drive.

Curious about what you see? Then why not try Dealer Auction for free for 30 days?

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £25,000. We then compare the sold price for each model with the Auto Trader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold. We crunch the numbers at the start of every new month.

Notes:

1The average ‘Auto Trader Retail Rating’ uses three key metrics to determine the consumer demand for the vehicle:

- Average days to sell – Calculated for the whole of the UK and then adjusted for the variations Auto Trader have observed locally in your area.

- Live market supply – Comparing the national supply level for the vehicle over the last seven days with the usual level of supply Auto Trader have seen in the market over the last six months.

- Live buyer demand – Analysing how many people are currently searching for the vehicle on Auto Trader, comparing consumer search behaviour over the last seven days against the level of interest over the last six months.