The results are in, and consistency is the name of the game for Dealer Auction in Q3. Although traditionally a less busy time of year (especially following the September plate change), we have seen hundreds of thousands of bids, an eye-watering amount of cash generated for sellers, and retail profit for buyers.

Better and better

Despite the slight slowdown, it was as busy a time as ever for alerts in Q3. We sent more than 3 million of them, matching buyers with the vehicles they need. That’s 200,000 up on the previous quarter. The number of auctions ended (32,249 to be precise), also saw an increase compared to Q2. Along with the hike in alerts, the number of auctions ended highlights the sheer choice customers have on our platform. That’s about to get even better, with all stock from Money4YourMotors now available, plus more vehicles from Hertz and Mercedes-Benz are on their way. And if that wasn’t enough to whet dealer appetites, we have big plans to bring even more consumer motors to the platform in 2024.

The wins in our sales

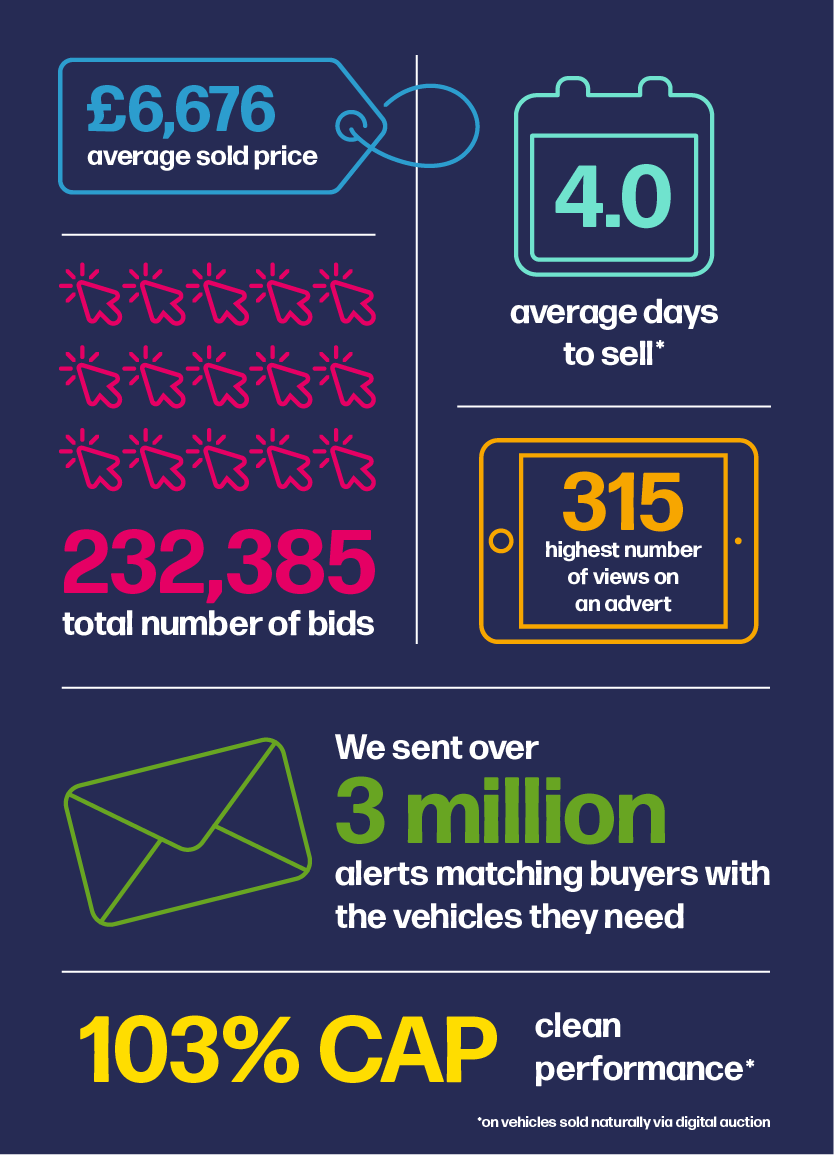

The average sold price on Dealer Auction remained buoyant in Q3, coming it at £6,676. And although there was a minuscule lift in days to sell at 4.0, that was just as expected given the conventionally slower time of year for the trade. Having said that, the digital route remains unquestionably swifter than traditional remarketing options. The platform’s CAP clean performance* at 103.8% is a slight increase from the previous quarter and underlines how Dealer Auction continues to deliver strong performance for dealers. Our comparatively lower fees mean more money on the metal, so everyone wins.

Bids in quids in

The growing number of stock sources from manufacturers, dealers, fleets, auctions and consumers generated a total of 232,385 bids across the platform’s open network. That total is no doubt ably assisted and driven by relevant vehicle and market data local to postcode which ensures our eager army of active buyers can bid strong and fast.

Things can only get better

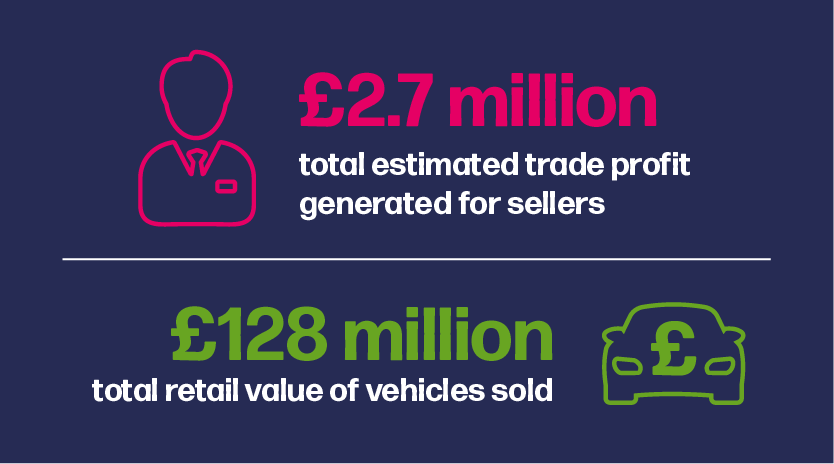

In Q3, the total estimated trade profit generated for sellers was a mighty £2.7million, and the total retail value of vehicles sold was an incredible £128.6million. As more and more savvy operators in the trade discover just how easy it is to sell on Dealer Auction, thanks to our alerts, eager buyer base and frequency of auctions (among other things), those figures look set to increase further.

Younger stock profile

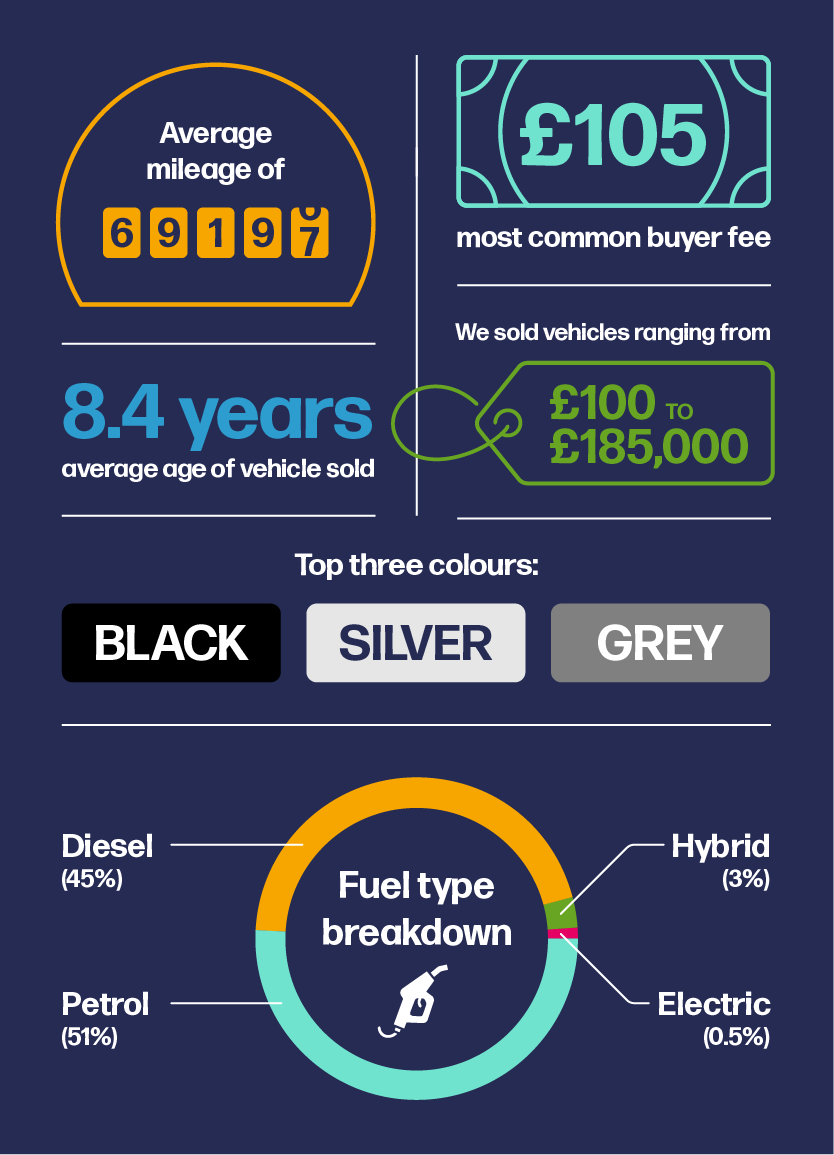

The past four months have seen a notable change in stock profile, with fewer miles and slightly younger vehicles on average. The average age in Q3 was 8.4 years, while mileage clocked in at 69,197 – both figures are less than the Q2 results. This indicates that the choice of vehicles is getting even better as used supply increases. So, it’s hard to think of a better time for retailers to get involved and boost their bottom line.

Another significant change in Q3 regarding the range of vehicles on offer relates to price. The lowest priced vehicle recorded was £100 (in Q2 it was £150), while the highest was a whopping £185,000. In the previous quarter, the highest price was £146,500. The £185,000 car in question, a beautiful Porsche 911 GT3 (992), had a CAP clean of £179,700.

Bigger vehicles mean bigger margins

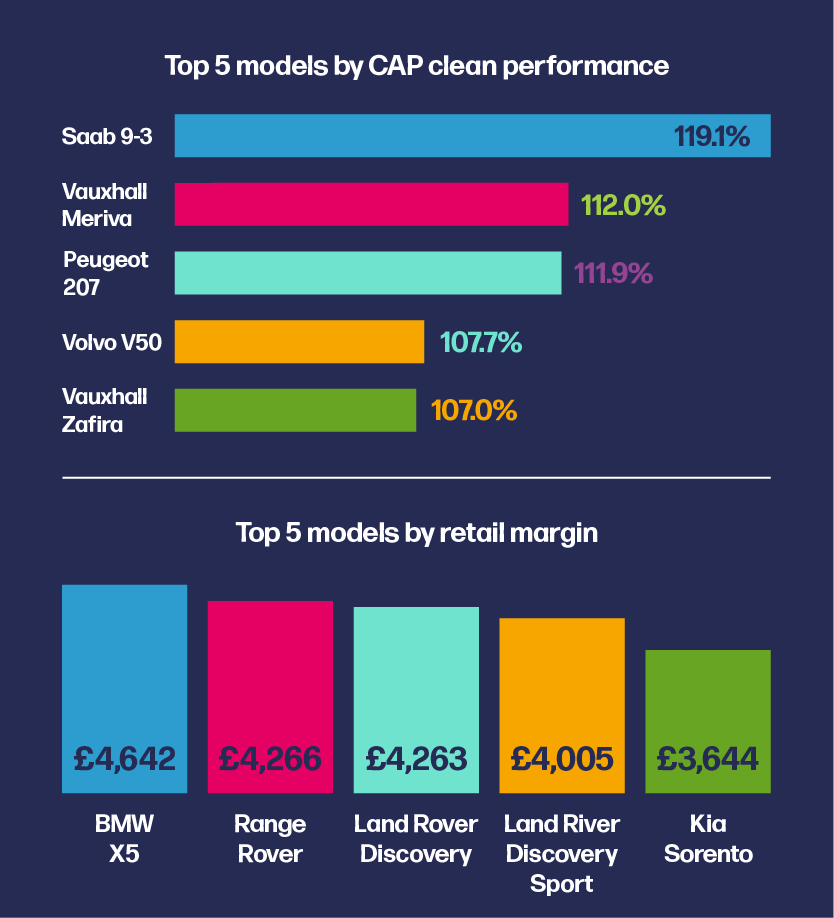

While our Q3 figures show that family cars are proving to be popular with buyers, with several family saloons making impressive money compared to CAP books, the biggest margins are still with the big boys, as it were.

Our top five lists for both CAP clean performance and retail margin continue to be dominated by SUVs. The BMW X5 is a new entry, jumping straight in at no.1 for margin performance. Land Rovers and Kias have stayed true to form and retained their places on the rundown.

The UK’s smartest digital wholesale marketplace

Dealer Auction is all about making buying and selling used vehicles easier and more profitable for everyone. We’re backed by unique data insights and clever tools that help you make the best decisions.

Sound good? Why not sign up for a free 30-day trial?